How Much Can I Claim For Working From Home During Covid

If your employer pays you an allowance towards these expenses you can get up to 320 per day without paying any tax PRSI or USC on it. For example if you multiply 320 hours by 080 per hour you get 256.

26 Things To Do In Amsterdam At Night Dymabroad Amsterdam Things To Do In Amsterdam Pictures Netherlands Travel

Evie can claim 50 of her 80 monthly internet bill x 4 months 160.

How much can i claim for working from home during covid. This means you could claim a deduction of 256 when you lodge your tax return. You can claim tax relief on more than 6 per week if you consider your actual home working costs are higher but HMRC will require you to provide records and receipts in support of the increased costs and the time taken to process the claim may take longer to complete. Shortcut method the new 80c method.

July 24 2020. On Nov 30th 2020 the CRA announced a new temporary flat rate method for calculating home office expenses that allows Canadians working from home due to COVID-19 to claim a deduction of up to 400. How much you can claim You can either claim tax relief on.

At home on a full-time or part-time basis. Yet during the 2020 lockdown HM Revenue Customs HMRC launched a microservice which even if you only needed to work from home for a day allowed you to get a WHOLE years tax relief. And that applies for the 202122 tax year too meaning many are due TWO years relief worth up to 280.

Remote working is where you are required to work. Eligible employees are able to deduct up to 2 for each day they worked from home in 2020 due to COVID-19 up to a maximum of 400 without having to provide any special forms or documentation to. Evie cant claim phone or internet as its included in the 80c per hour rate.

Evies total work from home claim for March June 69396. A refund is available to anyone who has worked at home. Even if youre now returning to the office you can claim tax back on household expenses for.

Working for substantial periods outside your normal place of work. But did you know that employees might be able to claim tax relief for some of the bills they have to pay due to working from home. For example if you worked from home for 8 weeks and you worked 40 hours each week that would be 320 hours.

From 6 April 2020 employers have been able to pay employees up to 6 a week tax-free to cover additional costs if they have had to work from home. Part of the time at home and the remainder in your normal place of work. IF you were told to work from home during the coronavirus pandemic you can claim tax relief from the government worth up to 125.

The saving is worth up to 125 per year for each employee and eligible workers can claim the full years entitlement if they have been told to work from home by their employer even if it has been. South Africans can claim a tax deduction if they have worked from home for more than half of their total working hours or for more than six months during the tax year that started in March 2020. 6 a week from 6 April 2020 for previous tax years the rate is 4 a week - you will not need to keep evidence of your extra costs the.

We at TurboTax want to ensure you have all of the information you need to make a claim. Sending and receiving email data or files remotely. Your employer can pay you a contribution towards these costs or you can make a claim for tax relief at the end of the year.

Evie can claim 38 hours per week x 80c x 16 weeks 48640. If your employer pays you a working from home allowance towards these expenses you can get up to 320 per day without paying any tax PRSI or USC on it. If you fall under the basic tax rate band of 20 you can claim tax relief on the coronavirus working from home expenses you incur per week.

E-working and tax relief If you are working from home you may be eligible for tax relief on expenses like light heat telephone and broadband. Claiming Expenses When Working From Home During the COVID-19 crisis many employees were asked to work from home. Logging onto a work computer remotely.

In the event that a salaried employee spent more than 50 of aggregate working hours in the 2021 year of assessment 12 months ending 28 February 2021 working in. To claim for tax relief for. The federal government continues to support working Canadians during the COVID-19 pandemic.

When you have worked out the total hours you multiply it by 080. Over the course of the year this could mean customers can reduce the tax they pay by 6240 or 12480 respectively. YOU could claim up to 500 extra cash due to working at home.

Therefore in this case.

Return To Office Employees Are Quitting Instead Of Giving Up Work From Home Bloomberg

4 Important Tax Considerations When Working Remotely Due To Covid 19

Working From Home In Covid Era Means Three More Hours On The Job Bloomberg

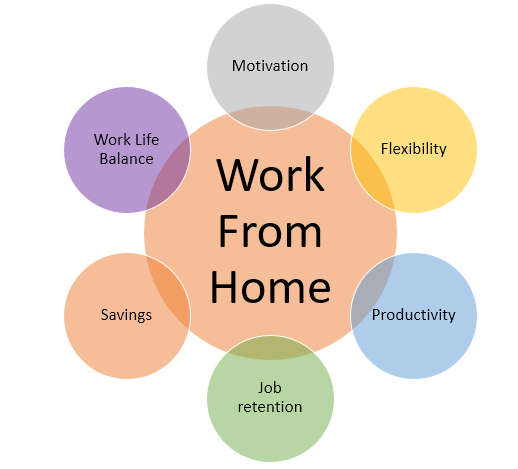

Work From Home Wfh Meaning Importance Steps Mba Skool

Why Working From Home Is Good For Your Well Being In 2020 Working From Home Legitimate Work From Home Home Based Jobs

Remote Work Statistics Navigating The New Normal Flexjobs

Work From Home Work Images Working From Home Graphics Inspiration

Worksafenb Working Safely From Home

How I Get More Done With The Little Time I Have First Year Teaching Teaching Methods Teaching Philosophy

15 Great Work From Home Jobs For Moms And Dads Flexjobs

Will We Work From Home After The Pandemic The Atlantic

Will We Work From Home After The Pandemic The Atlantic

Surprising Working From Home Productivity Statistics 2021

Post a Comment for "How Much Can I Claim For Working From Home During Covid"